The Feb 2017 Aspen Snowmass Real Estate Monthly Market Snapshot was postedinCurrent Reportsthis morning, Mar 6th. The Monthly Snapshots are usually posted on or near the 1st Monday of the month. The Q4 and Year 2016 report will be released soon.

Anarticleappeared in the Denver Post Sunday Feb 26th on Colorado Mountain resort real estate including Aspen and Pitkin County.

Bottom Line Feb 2017 Excerpt:

“For year-to-date (YTD), Jan 1 through Feb 28, 2017, the total combined Aspen Snowmass Village market is up 19% in dollar sales to $139M from $117M same time last year and no change in unit sales with (43) in 2017 versus (43) last year.

The number of under contract properties for the combined Aspen Snowmass Village market is up 52% to (35) in Feb 2017 versus (23) same time last year.

Under Contracts are used as an indicator of future activity when compared to the prior year.”

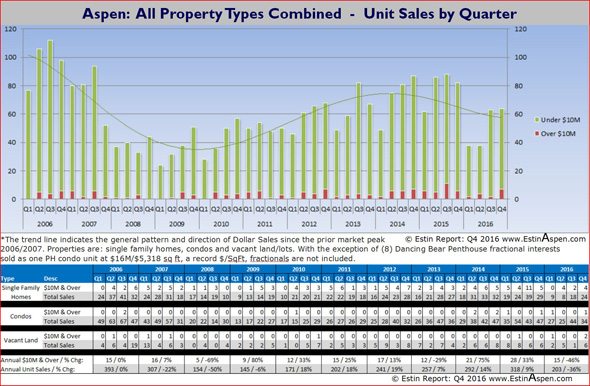

New Charts: Historic Pace of Aspen and Snowmass Village Homes, Condos and Vacant Land / Lots by Dollar Sales and Unit Sales

These new charts were posted inCurrent Reportson 02/15/17.They are: the historic pace of dollar and unit sales since 2006 with trend lines for Aspen and Snowmass Village (SMV) separately by: 1) all properties combined; 2) single family homes; 3) condos; 4) vacant land / lots. (Fractionals, with the exception of extreme sales, are not included.)

Sales velocity, or pace, whether by dollar volume or unit sales is extremely useful to consider ss the unit sales drop-off in the 2nd Half 2007 so foreshadowed the Great Recession.

While many real estate professionals use dollar volume sales as the single metric for sales performance (it often looks ‘better’), unit sales are a more reliable measure of market activity. Dollar sales can be skewed disproportionately by extreme high or low end priced sales.

Clients often ask, “Where are we now compared to the Great Recession…?”. These charts offer a solid reference for that conversation. In this instance, the starting point for the trend line is 2006, but, of course, where the trend line commences will affect its outcome…If the charts had started at 2009, the trend would be more upwards at present than is shown here.

As this is written, post-election Nov 2016 through Feb 15, 2017, sales have picked up considerably and are decidedly on an upward trajectory.

Click chart to see additional breakdown chartsfor Aspen and SMV by property types.

“Flip Job” Examples: See recent Before/After redevelopmentin the new Flip Jobs Sectionnear the bottom of the Menu Bar on the left. These are properties that have been recently or are currently in the process of redevelopment for re-sale. This post is updated (01/04/17) as additional re-sale properties come on the market at significantly higher prices.

___________

Market Activity Week 9, February 26 – March 5, 2017

Aspen Snowmass real estate weekly sales and under contract activity appears below for all Aspen, Snowmass Village, Brush Cr Village, Woody Creek and Old Snowmass properties over $250,000 excluding fractionals in the upper Roaring Fork Valley. As the MLS links below expire after 30 days, photos and written descriptions of select closed properties (those with excellent photography) are posted here to preserve an archive of sold market activity. Scroll down the page for home photos and details of weekly sales and under contract / pending Aspen properties in the past 4 weeks. For earlier dates, use the down arrow to quickly find blog archives by year and date to 2008. Or useSearchEstinAspenin the menu bar to search by topic, address, subdivision, complex, date, etc. If it’s about Aspen real estate, the information should be here.

Closed (5):MLS#s 144182, 140993, 147050, 144756, 140161.This link is valid until 4/4/2017.

Under Contract/Pending (5):MLS#s 138870, 141615, 145207, 146533, 147227.This link is valid until 4/4/2017.

Aspen Snowmass Solds Last Week:

Recent Estin Report tweets on Aspen Real Estate

{loadposition articlepos}

Disclaimer: The statements made in The Estin Report and on Aspen broker Tim Estin’s blog represent the opinions of the author and should not be relied upon exclusively to make real estate decisions. A potential buyer and/or seller is advised to make an independent investigation of the market and of each property before deciding to purchase or to sell. To the extent the statements made herein report facts or conclusions taken from other sources, the information is believed by the author to be reliable, however, the author makes no guarantee concerning the accuracy of the facts and conclusions reported herein. Information concerning particular real estate opportunities can be requested from Tim Estin at970.309.6163or byemail.The Estin Report is copyrighted 2017 and all rights reserved. Use is permitted subject to the following attribution with a live link to the source:“The Estin Reporton Aspen Real Estate.”

____________________________________________________________________________________