Q125: Jan-Mar 2025. The Estin Report publishes an 11-page monthly Aspen Snowmass real estate market “Snapshot” on or near the 1st Monday of each month. They present a “bottom line” summary and the raw data from the subject month and Year-to-Date (YTD) performance for residential free market real estate sales… Read More

This Section contains Estin Reports: Aspen Snowmass Real Estate Market Reports and Monthly Snapshots for the past 12 months. Prior year reports and monthly snapshots are archived in the Past Reports section.

The reports are:

1) Bi-Annual: State of the Aspen Snowmass Residential Real Estate Market Report: The most current and timely narrative and and scrubbed stats available.

2) Monthly Aspen Snowmass Residential Market Report Snapshots: Aspen Snowmass real estate summary (10 pages of detailed monthly stats and ‘bottom line’ commentary) released on or near the 1st Monday of each month. Includes sales stats by neighborhoods in 6-month periods that includes the subject month (Pgs 7 & 9).

3) Weekly Blog: Aspen Snowmass Weekly property closings and under contract activity is posted every Monday morning, sometimes in-between. Lots of photos, details and comments. At the bottom of the Blog Section are the Blog Archives by year from 2006.

4) Aspen Snowmass Real Estate Historic Pace of Sales Charts: updated every quarter showing Aspen and Snowmass Village residential dollar and unit real estate sales by area and property types (past 10 yrs) and trend lines.

Jan 2025 Aspen Snowmass Real Estate Market Report

v1.5 The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary of residential real estate sales in Aspen and Snowmass with scrubbed sales data for the subject month… Read More

Estin Report: Aspen Real Estate Market 2024 Year in Review, Looking Forward (2025 WS)

01.24.25 Posted online for PDF download. The 32- page print edition is available after Feb 7th in racks outside Sotheby’s offices at 300 S Spring St (my office across from the Aspen Art Museum), 415 E Hyman Ave on the Hyman Mall, the Info Kiosk opposite Paradise Bakery, outside Clark’s… Read More

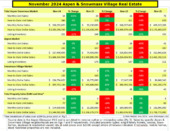

November 2024 Aspen Snowmass Real Estate Market Report

v2.2 The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary of residential real estate sales in Aspen and Snowmass with scrubbed sales data for the subject month and year-to-date (YTD) performance… Read More

October 2024 Aspen Snowmass Real Estate Market Report

v4.0 The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary of residential real estate sales in Aspen and Snowmass with scrubbed sales data for the subject month and year-to-date… Read More

August 2024 Aspen Snowmass Real Estate Market Report

v2.0 The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary and raw sales data of the subject month and YTD performance for residential real estate sales in Aspen and… Read More

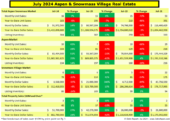

July 2024 Aspen Snowmass Real Estate Market Report

v1.4 (updated from v1.2 on Pgs 7, 9-11 to reflect 6 mos median average sales rather than 3-mos avgs.) The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary and… Read More

2024 Mid-Year Luxury Real Estate Outlook

I am pleased to introduce the next iteration of Sotheby’s coveted 2024 Mid-Year Luxury Outlook℠ report. The report is a comprehensive review of the forces and trends impacting high-end residential real estate markets across the globe for the remainder of the year. This year, policy shifts and elections in nearly… Read More

Estin Report H1 2024 Aspen Snowmass Real Estate Market (SF)

Released online 07.18.24 v2.92 Executive Summary Current Market Overview – Unit Sales: In H1 2024 , Aspen unit sales increased 24% over H1 2023, while Snowmass decreased 25% due to a pause in new condo construction offerings. Unit sales are a better measure of… Read More

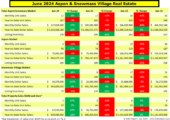

June 2024 Aspen Snowmass Real Estate Market Report

v1.71 (rev. Jul 11, 24) The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary and raw sales data of the subject month and YTD performance for residential real estate… Read More

May 2024 Aspen Snowmass Real Estate Market Report

v1.70 The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary and raw sales data of the subject month and YTD performance for residential real estate sales in Aspen and… Read More

April 2024 Aspen Snowmass Real Estate Market Report

v1.75 The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary and raw sales data of the subject month and YTD performance for residential real estate sales in Aspen and… Read More