v1.71 (rev. Jul 11, 24) The Estin Report publishes a 10-page monthly Aspen real estate market “Snapshot” on or near the 1st Monday of each month. The Snapshot presents a “bottom line” summary and raw sales data of the subject month and YTD performance for residential real estate sales in Aspen and Snowmass. There are three sections: 1) Total combined Aspen Snowmass Village Market; 2) The Aspen Market; 3) The Snowmass Village Market. It features charts, tables and 30-day live links to photos and details of sold properties and compares the subject month to the same time in prior years. The Monthly Snapshot is the only Aspen and Snowmass property sales information widely published in a timely and consistent manner early each month.

BOTTOM LINE

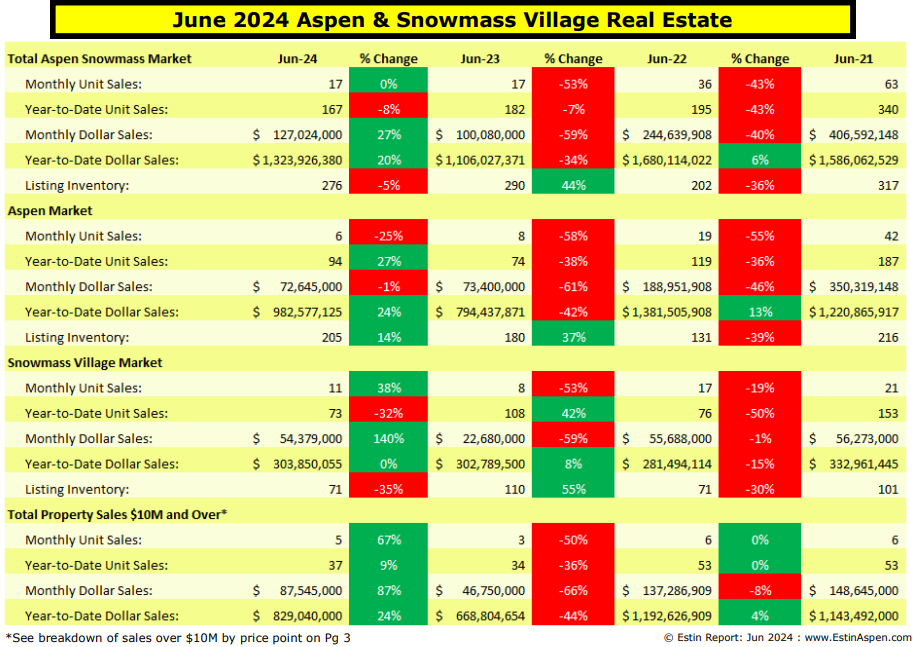

H1 2024 OVERALL SALES – ASPEN & SNOWMASS VILLAGE COMBINED

For 2024 YTD through June, dollar sales are up 20% over last year due to an abundance of individual property sales over $10M ($741M vs $622M last year). In April, there were (4) home sales over $40M totaling $293M alone, two of which were associated with the same seller/buyer.

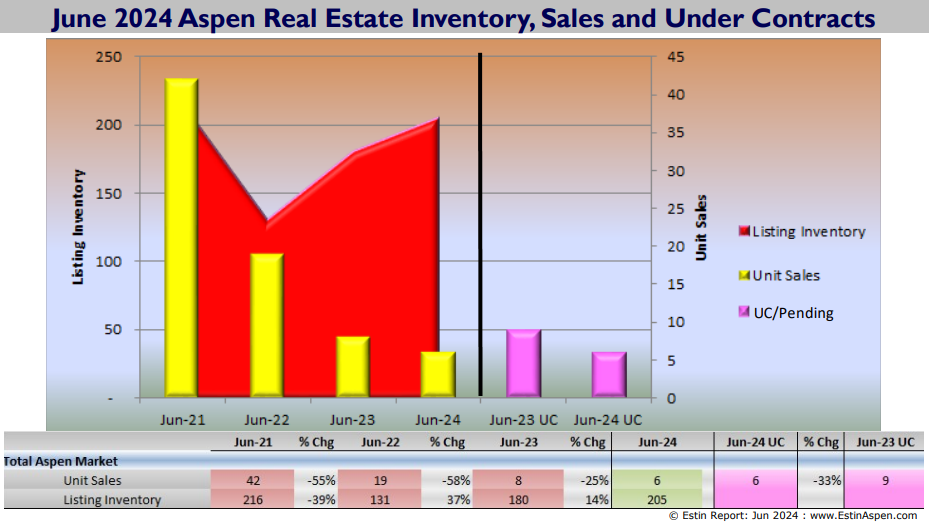

Unit sales for the combined market – a more realistic measure of market performance – are down 8%, (167) sales 2024 YTD vs (182) in 2023 YTD.

Reasons?

Inventory remains historically low – fewer buyer choices; interest rates, to the extent they effect lower priced sales, remain relatively high; and prices persist at record levels although the spread between ask to sold prices may be widening depending on individual circumstances. Whereas that spread has stubbornly been between 3-6%, there are more instances recently of it falling between 5-10%.

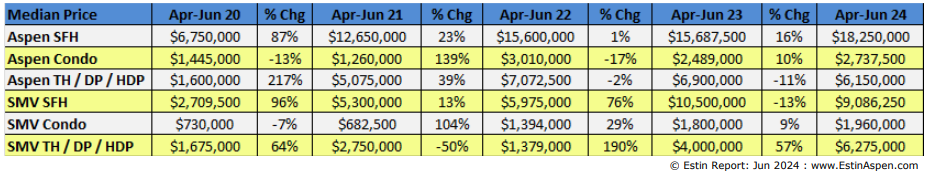

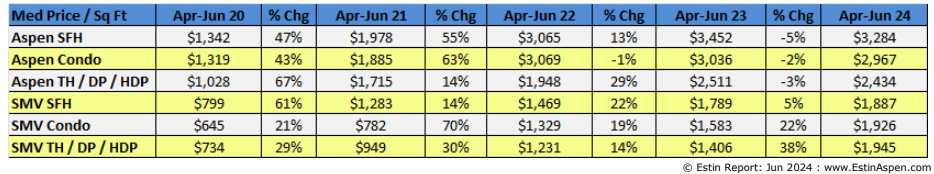

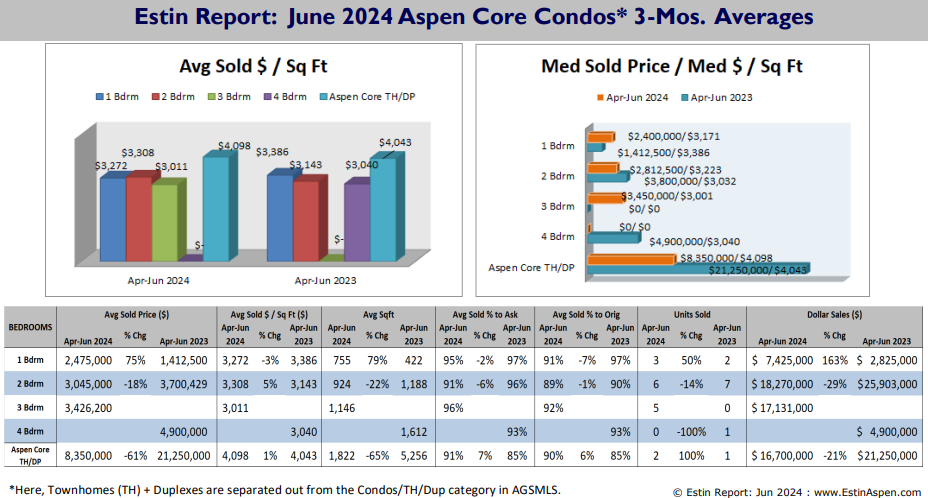

ASPEN MEDIAN SOLD PRICES (median: Apr, May, Jun)

For the Aspen market only (does not include Snowmass Village), the median June 2024 sold price of an Aspen single family home was $18.25M/$3,284 sq ft versus $15.7M/$3,452 sq ft same time last year – the median price increase can be attributed to the (9) Aspen home on/off market sales over $30M in the 1st Half of the year; for Aspen condos, the median sold price was $2.74M/$2,967 sq ft now versus $2.49M/$3,036 sq ft then. Aspen condo sales have been particularly active: up 68% in 2024 YTD, $129M vs $76M in 2023 YTD; unit sales are up 52%, (41) sales in 2024 YTD vs (27) in 2023 YTD.

ASPEN SOLD TO ASK PRICES

Single family Aspen homes in the $3M-$7.5M difficult to impossible to find range are selling at 89%-97% sold-to-ask price range – these are older homes requiring significant remodel/updating, if not selling almost entirely at lot value. Generally, the lower the home price, the greater the sold to ask spread; for sales between $7.5M-$9.99M, there was just one sale at 83% of ask; between $10M-29.99M at 93%-96%; for sales over $30M, the selling range is 93%-100% of ask.

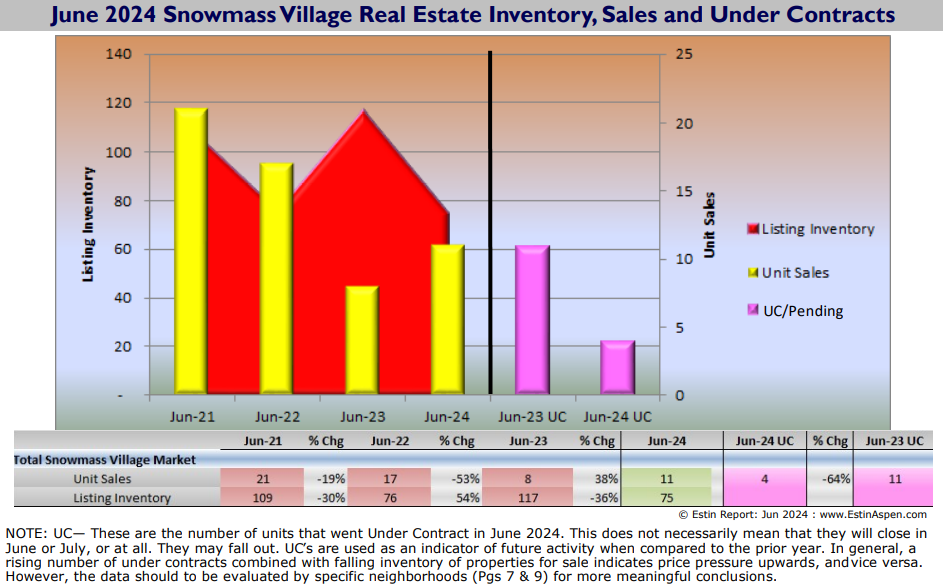

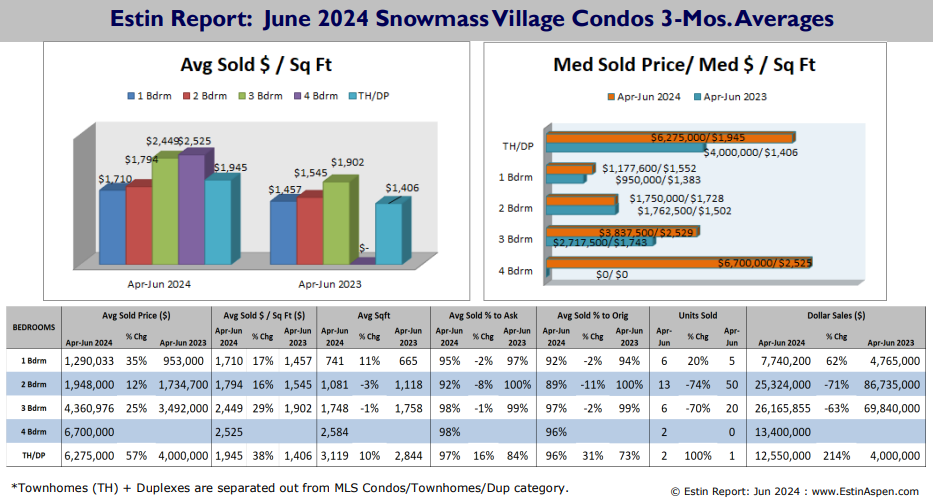

SNOWMASS VILLAGE MEDIAN SOLD PRICES (median: Apr, May, Jun)

In Snowmass Village (SMV), the median Apr-Jun 2024 sold price of a single family home was $9.1M/$1,887 sq ft versus $10.5M/$1,789 sq ft Apr-Jun 2023. In Apr-Jun 2024, there were (5) sales bet. $10-20M; in Apr-Jun 2023, there were (3) sales); the median sold price of an SMV condo in June 2024 was $1.96M/$1,926 sq ft versus $1.8M/$1,583 sq ft in June 2023.

SMV condo unit sales are dramatically down 45% in 2024 YTD, (53) vs (96) last year, as new built Base Village inventory has quickly sold out its recently completed projects offered at pre-construction prices upon their initial offerings two years ago. A new and the final Base Village offering, Stratos Snowmass, began their pre-construction selling program in early June. When that project sells out, there will only be re-sales throughout the Base Village, with no newer future development planned or approved at this time.

SMV SOLD TO ASK PRICES

All SMV homes between $3M-$20M are selling within a tight range of ask prices, 96%-99%. Yet there was one ‘outlier’ sale at 1500 Ridge of Wildcat for $24.5M/$1,909 sq ft, that closed at 71% off ask price of $34.5M.

CURRENT MARKET TRENDS

The prevailing market trends are: low inventory, a forthcoming stricter land use code further limiting house size to 8,750 sq ft creating premium value for existing larger homes (currently allowed is 9,250 sq ft reduced from 15,000 sq ft in Nov 2023) and premium prices paid for new built and like-new remodeled properties in move-in ready condition. The time required to build new or substantially remodel a single family home in Pitkin County and the City of Aspen is 3 1/2 years under the best of circumstances to almost 5 years giving oneself some degree of cushion. At the same time, demand continues for our high quality of life – with remote work ease – in our world class mountain environment.

THE SUMMER SEASON

Inventory of properties for sale has increased substantially throughout June – at least in Aspen, far less in Snowmass Village – in anticipation of the summer selling season. The big “But” is that it remains at an historically very low level. Sellers remain confident and in a number of cases appear to be reaching high, often at 10-15% above the most recent comparable sale. There’s a sense of “get it while you can” and with the historically low inventory levels as they are, why not try.

Select charts and tables from the June 2024 report

June 2024: Aspen & Snowmass Village Single Family Homes Median Prices for Apr, May, Jun (Pg4)

June 2024: Aspen & Snowmass Village Single Family Homes Median Prices per Sq Ft for Apr, May, Jun (Pg4)

Links to Jun 24 Aspen and Snowmass Village Sold Property Photos and Details:

Aspen June 24 Closed Properties.

Snowmass Village June 24 Closed Properties.

Vacant Lots June 24 Closed Properties.

___________