Released Nov 8, 2016 v2.1

Click table above for Oct 2016 Aspen Real Estate Snapshot (10 Pg PDF)

Bottom Line

September thru mid-October is typically the most active sales period of the year as summer ‘lookers’ become fall buyers in order to secure and get their new properties ready for winter.

Sep ’16 was down considerably from same time last year, and Oct ’16 is no different. Demand (sales) is way off; supply (inventory of properties for sale) is increasing. Prices, for the most partwith the exception of unique or like-new properties, are trending downward.

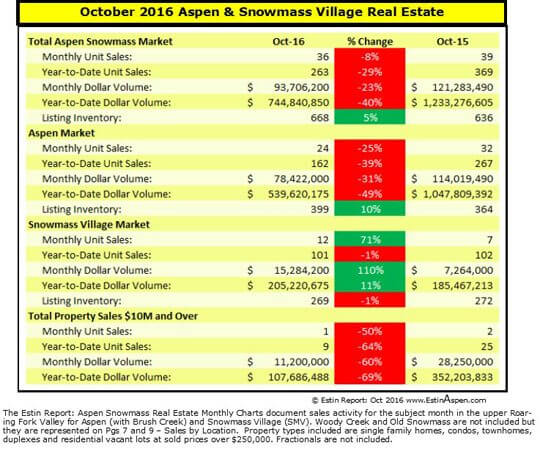

Aspen Single Family Homes: In Oct 2016, Aspen single family home unit sales fell -45% with 6 sales this Sep from 11 same time last year; dollar sales were off -60% with $31M in sales this Oct versus $77M a year ago. Year to date, unit home sales are down -56% to 41 this Oct from 93 last year; dollar home sales are off -62% to $253M from $664M last year. The avg. sold price per sq ft for an Aspen single family home was $1,544 sf in Oct ’16.The inventory of active Aspen single family homes for sale is up 12% (179) in Oct ’16 versus (160) in Oct ’15.

Aspen Condos: Oct 2016 Aspen Condo sales are off significantly but not as much as the home market: unit sales fell -21% with 15 sales this Oct from 19 same time last year; dollar sales were off -16% with $27M in sales this Oct versus $32M a year ago. Year to date, condo unit sales are down -26% to 111 thru this Oct from 151 last year; condo dollar sales are off -12% to $232M from $295M last year.The avg. sold price per sq ft for an Aspen condo was $1,233 sf in Oct ’16 The inventory of active Aspen condos for sale is up 5% (159) in Oct ’16 versus (152) in Oct ’15.

Sales over $10M: Sales of Aspen properties over $10M have plummeted: in Oct 2016, there was 1 sale versus 2 the same time last year; Year to date, there have been 9 sales this year versus 25 last year, -64%. Dollar sales in this category have plunged commensurately: for Oct ’16 they were $11M versus $28M same time last year and for YTD, they were $108M thru Oct ’16 versus $352M last year. Most real estate prognosticators use unit sales as the critical ‘activity’ metric, not dollar sales.

SMV Single Family Homes: In Oct 2016, SMV single family home unit sales fell were even with 2 sales this Sep and 2 the same time last year; dollar sales were up 79%% with $6.9M in sales this Oct versus $3.9M a year ago. Year to date, unit home sales are up 26% to 34 this Oct from 27 last year; dollar home sales are up 21% to $136M from $112M last year. The avg. sold price per sq ft for a SMV home was $908 sf in Oct ’16. The inventory of active SMV single family homes for sale is up 9% (72) in Oct ’16 versus (66) in Oct ’15.

SMV Condos: Oct 2016 SMV Condo unit sales are up 150% with 10 sales this Oct from 2 same time last year; dollar sales were 243% with $8.3M in sales this Oct versus $2.4M a year ago. Year to date, condo unit sales are down 10% to 63 thru this Oct from 70 last year; condo dollar sales are off -10% to $60.9M from $67.6M last year. The avg. sold price per sq ft for a SMV condo was $675 sf in Oct ’16. The inventory of active SMV condos for sale is down -4% (177) in Oct ’16 versus (184) in Oct ’15.

As written in my Sept ’16 analysis, the following applies to Oct ’16 as well:

Prices: Prices are coming down as sellers seasonally adjustdownward to post-summer, pre-winter realties and as greater motivation sets in. An average 5-10% discount to ask price is common, and in some cases more. Pages 7 and 9 of this Market Snapshot identify sales by Aspen and Snowmass Village location/neighborhoods with average sales to ask and original price discounts.

Why is this happening:Everyone is asking. What’s going on? …It isn’t just Aspen. The high-end luxury market is pretty much getting decimated everywhere: the Hamptons are reportedly off by 50% this year, Miami is way off, NYC high end has crashed (developer inventory surplus cited).

There is a pervasive sense of uncertainty over any number of things: first and foremost, the US election – fear of either electoral outcome; disarray in the oil markets effecting (or not?) Aspen’s significant Texas market; a slowing global economy linked especially to China’s slower growth and trade imbalances; Aspen’s largest foreign buyer segment from Brazil and Australia deraileddue to, respectively, a weakened economy and a plunge in commodity prices; Brexit; Mosquitoes; Terrorism…Ambient fear – the looking over of one’s shoulder – what are we missing that’s going to blow up, 2008 crisis-like, all over again? Who knows ..? But all of which have combined to take many buyers out of the market.

Yet the time of maximum uncertainty is often the best time to get into the market…

There have been some great buys in the past two months, and buyers would do well to dig deep, find motivated sellers and pull the purchase trigger.This “down” year is not going to last indefinitely and many believe there will be a post-election turnaround sooner than later… On the day before the 2016 Presidential election, the stock market closed up 371 pts or 2.1%.

*This summary focuses particularly on the Aspen market as Aspen historically accounts for approximately 70-75% of the total Aspen and Snowmass village combined market. The Market Snapshot pdf breaks out the Aspen and Snowmass Village markets separately and in detail.

Links to Oct 2016 Aspen and Snowmass Village Sold Property Photos and Details

Aspen Oct 2016 Closed Properties (21).This link is valid until 12/1/2016.

Snowmass Village Oct 2016 Closed Properties (12).This link is valid until 12/1/2016.

Vacant Lots Oct 2016 Closed Properties (3).This link is valid until 12/1/2016.

Disclaimer: The statements made in The Estin Report and on Aspen broker Tim Estin’s blog represent the opinions of the author and should not be relied upon exclusively to make real estate decisions. They do not represent the opinions or statements of Aspen Snowmass Sothebys International Real Estate. A potential buyer and/or seller is advised to make an independent investigation of the market and of each property before deciding to purchase or to sell. To the extent the statements made herein report facts or conclusions taken from other sources, the information is believed by the author to be reliable, however, the author makes no guarantee concerning the accuracy of the facts and conclusions reported herein. Information concerning particular real estate opportunities can be requested from Tim Estin at 970.309.6163 or by email. The Estin Report is copyrighted 2016 and all rights reserved. Use is permitted subject to the following attribution with a live link to the source: “The Estin Report on Aspen Real Estate.”

_____________________________________________