Released 08.17.21 v2.54

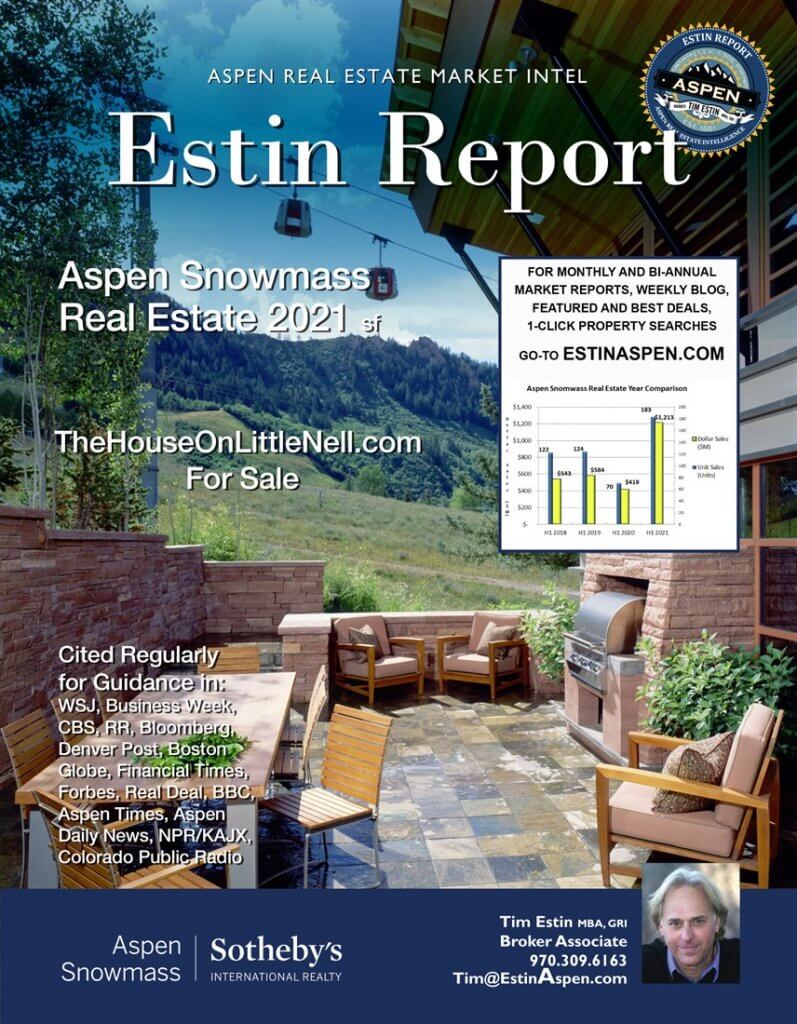

1st Half 2021: State of the Aspen Snowmass Real Estate Market

PRELUDE A veteran Aspen broker who has witnessed the market for over 50 years, once told me, “There are 3 stages of Aspen real estate inquiry: Shock, pissed off, surrender.” That was in 2005, 15 years before Covid.

BOTTOM LINE SUMMARY

We are more than half-way through the summer season 2021 and Aspen and Snowmass Village real estate sales continue on their pandemic related disruptor path. Explosive. Seismic. New threshold. New level. The local real estate business is hyper-active and intensely busy, similar to other high-end luxury markets across the country.

The local inventory of properties for sale is at its lowest level of the past twelve years and prices have been rising dramatically. The simple math: demand way up; supply way down; prices up, up and away.

We are in a fast-moving market where comps are a trailing indicator.

Sellers everywhere, in Aspen and Snowmass Village and down valley – at all price points and property types – are testing the market with new pricing. It’s a seller’s game. At minimum, buyers are meeting the ask prices or within 1% – 3% of ask, if not over ask. “Deals” are history, few and far between. The reality is – it’s far more productive and profitable over time to accept today’s pricing than deal hunting. Yesterday’s sale was the deal you missed.

There’s a new floor being set and when there’s a correction, the good properties, well located and like-new, will offer the most effective hedge. The Great Recession proved this point emphatically. When things do go south, on the next market cycle upwards, those properties in and closest to the Aspen Core, will be the most liquid, will recover the fastest and appreciate more quickly than all others.

We are seeing new properties come on the market at speculative prices where recent sold comps are no longer determinative reference points…Tomorrow’s ask price will be 10-30% higher. Brokers are scratching their heads and saying “I guess we’ll see…” In July and Aug ‘21, we are witnessing these new prices holding so far with little

local buyer resistance to what Realtors nationally are referring to as “seller’s greed.” Believe it. It’s a new world.

In a low inventory real estate market with surging demand, pricing and appraising is exceedingly difficult and is simply whatever the market will bear.

Sellers can both protect and add the most value to their property by remodeling, upgrading…as soon as possible.

PRICING

Aspen Single Family Homes: In H1 2021, there were 36 single family homes sold over $10M versus 15 the same time last year. That’s up 140%. The median Aspen home sold at $9.7M, the avg price was $12.5M. “Median” in real estate is considered a more accurate metric as it’s less likely to be skewed disproportionately by extreme high or low prices.

Aspen single family homes are regularly selling at about $2,000 per sq ft, and for newer or remodeled like-new product, new pricing is between $3,200-3,800 sq ft ask. Six months ago, sold prices were at $2,500-3,000 sq ft.

For some perspective, according to Elite Traveler, the most expensive world property markets (cities) are: Monaco $5,263 sq ft, Hong Kong $4,393 sq ft, New York is a steal at $2,466 sq ft and London merely $1,891 sq ft.

Aspen condos: the median sold condo price is $1.8M and the average sold price is $2.48M. The average 2 bedroom/2 bath condo between 900-1,100 sq ft sells at $1.754M/$1,880 sq ft, if not updated. An older unit requiring a remodel is $1,700-$1,900 sq ft. A like-new remodeled condo in downtown Aspen will cost $2,400-$3,000+ sq ft.

Lots: A so-so vacant lot or teardown/older non-historic home in Aspen’s prized historic West End where the average lot size is 6,000 sq ft, will cost $6.5M+… The starting point for the least expensive lot/vacant land in Aspen is $2M but more realistically high $2M’s: the highest priced lot sale in Aspen in H1 2021 was $12.25M out at Double Bar X Ranch between the roundabout and airport. In 2019, the highest priced vacant Aspen lot sold at $24.5M for 5-8 acres at the base of Red Mountain, and there were 3 other similar sales at $22-24M in the same area. These are known as the Rubey Family lots or American Lane lots. That’s right, we’re talk’in dirt.

Inventory: From the 2009/2010 low-point of the Great Recession through H1 2021 (Pandemic Rocket Ship), inventory of Aspen condos for sale has fallen 66% overall, or 7.5% per year. Condo inventory is at its lowest point now since 2005. It’s “slightly better” in Snowmass Village where inventory is down 47% during the same period, or down about 5% per year.

Inventory of Aspen homes for sale have fallen to their lowest level in 10 years. From (782) properties for sale in H1 12 to (443) in H1 21, down 43% total, or down 5.5% per year.

Snowmass Village: From 2009-2019, the Snowmass Village discount to Aspen home prices plummeted to 50-60%. Before then and historically, it was 25-30%. In the past 18 months, as the Snowmass Base Village comes closer to completion and build-out, this discount gap has been closing. Now it’s approximately 35-45%.

Inventory of homes for sale has fallen even more: From (589) homes for sale in H112 to (304) in H121, down 48% in total, or down 6.4% per year.

As Aspen prices reach skyward, Snowmass Village properties – a staggeringly beautiful resort in its own right – have become more appealing to a growing number of buyers who once insisted on Aspen only.

FINANCIAL MARKETS

Often said, often repeated: As Wall Street goes, so goes Aspen.

Listening to CNBC the other day, Robert McNamee of Elevation Partners said “We are late in the long market

cycle…There are so many cross currents in the market right now”.

When I asked a money manager client, “What do you think is going on – how long do you think this will last?”, he replied, “If you believe in the transition to the digital economy, as I have for the past 10 years, it still has a long way

to go. The change we are undergoing is so fundamental and all-encompassing.”

In his book, “Post Corona”, author Scott Galloway calls the pandemic the “great accelerator”. High tech changes that were predicted as being 10 years off pre-Covid are happening now. Full throttle.

Ten years of the future. Now.

(Download full 32 Pg report as PDF from button on the right.)