A different type of value hunter is propping up the market in Pitkin County. The county as a whole endured a flat year, but the high-end markets in Aspen and Snowmass Village saw dollar volume climb 15 percent and transactions climb 25 percent. The two tony enclaves saw 16 sales over $10 million in 2011, compared with only 10 in 2010.“High-end buyers realized they could get great value,” said Aspen broker Tim Estin, who writes a quarterly market analysis called the Estin Report. “What was once $30 million was selling for $15 million or $20 million.” Signs for January 2012 are varied. San Miguel County saw the slowest January in several years, with 24 sales stirring only $9.6 million, compared to January 2011’s 33 sales worth $25.3 million. But Aspen-Snowmass saw a very strong January, with 29 deals worth $98.26 million. That’s up from 20 deals worth $79.48 million in January 2011, a month that floated hope for a rebound after a dismal 2010. “But back in January 2011, there was just as much positive news as this past January, so while I’m optimistic, things could be derailed just as they were last year,” Estin said.

By Jason Blevins, March 4, 2012, Denver Post

Full article:

Colorado resort homes sell at slower pace, lower prices By Jason Blevins, 03/04/2012, The Denver Post

Real estate sales in Colorado’s six resort counties, in dollar terms, fell more than 10 percent in 2011, a year that saw hopes for a rebound fizzle.

While high-end pockets like Aspen, Snowmass, Vail Village and Beaver Creek enjoyed strong sales last year, the widespread boomtimes that saw prices peak in 2007 and four mountain counties surge past $1 billion in annual sales seem long gone.

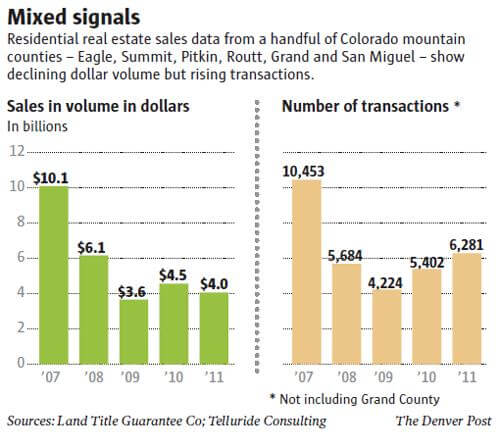

Since the high point of 2007, when Eagle, Pitkin, Summit, Routt, Grand and San Miguel counties saw more than $10 billion in combined residential and commercial sales, real estate activity in the resort-anchored communities of Colorado’s high country has fallen more than 60 percent.

Measured in transactions, the numbers are a bit more encouraging. Total transactions in the five counties excluding Grand rose to 6,200 last year from a low of 4,200 in 2009, but that’s still well below the 2007 level of 10,400. In other words, sales are rebounding but at much lower prices, and some of the growth is coming from bank sales.

Last year was supposed to be the comeback. Several counties saw vibrant sales in January 2011, fueling hope of a turnaround from the 2009-10 stretch that saw the collapse of the mountain real estate market.

But July 2011 deflated any anticipation for recovery with the worst month in a decade. For the rest of the year, high-country real estate buying and selling either fell or stalled, erasing any gains from the first half of the year.

Brokers float a flurry of reasons behind the continued decline in sales: Political squabbling over national debt. Financial pains in Europe and other international markets. Reticent investors and wary lenders.

One segment that’s up in the high-country real estate market is bank sales and foreclosures, following a trend that has mountain-town foreclosures peaking well behind the Front Range. Routt, Pitkin, Summit and Eagle counties saw the number of bank sales double in 2011.

Last year Eagle County logged 293 bank sales, up from 103 in 2010, with most of those found in the downvalley towns of Eagle and Gypsum. Add in the flood of short sales in Eagle and Gypsum, and prices keep falling. The two towns accounted for more than 28 percent of Eagle County’s 1,357 real estate deals last year, but less than 9 percent of its total sales volume. In Gypsum, the median sales price fell 30 percent in 2011, from $260,800 in 2010 to $180,000 last year.

“There’s been a lot of activity with short sales, and that is driving our property values down,” said Gypsum broker Laurie Slaughter with the Slaughter Realty Group.

Slaughter sees more first-time homebuyers entering the market and taking advantage of the low prices, leaving the area’s supply of affordable for-sale homes whittled to a recent low.

“In the $200,000 to $300,000 range, very few properties stay on the market very long,” Slaughter said.

A different type of value hunter is propping up the market in Pitkin County. The county as a whole endured a flat year, but the high-end markets in Aspen and Snowmass Village saw dollar volume climb 15 percent and transactions climb 25 percent. The two tony enclaves saw 16 sales over $10 million in 2011, compared with only 10 in 2010.

“I think high-end buyers realized they could get great value,” said Aspen broker Tim Estin, who writes a quarterly market analysis called the Estin Report. “What was once $30 million was selling for $15 million or $20 million.”

Signs for January 2012 are varied. San Miguel County saw the slowest January in several years, with 24 sales stirring only $9.6 million, compared to January 2011’s 33 sales worth $25.3 million. But Aspen-Snowmass saw a very strong January, with 29 deals worth $98.26 million. That’s up from 20 deals worth $79.48 million in January 2011, a month that floated hope for a rebound after a dismal 2010.

“But back in January 2011, there was just as much positive news as this past January, so while I’m optimistic, things could be derailed just as they were last year,” Estin said.