Synopsis of the numbers: Paid $17.75M 11/2010; sold Little Annies for $2M (2016); sold PH for $25M (11/2015); sold commercial retail and office space $28 (02/2018) = Cost -$17.75 +$2M+$25M+$28M = $37.25M gross payday. For more history on the property and Aspen Core's acquisition in 2010, click here. Read More

Wyly Estate in Woody Creek CO Closes at $13.4M/$966 Sq Ft from Original Ask $33.5M

Feb. 18 – 25, 2018 Estin Report: Last Week’s Aspen Snowmass Real Estate Sales & Stats: Closed (10) + Under Contract / Pending (17) Estin Report Jan 2018 Aspen CO Real Estate Market Monthly Snapshot was released Feb 13… Read More

New Contemporary Aspen CO Home for Sale at 135 Miners Trail Closes at $21.5M/$2,621 Sq Ft

Feb. 11 – 18, 2018 Estin Report: Last Week’s Aspen Snowmass Real Estate Sales & Stats: Closed (7) + Under Contract / Pending (8) Estin Report Jan 2018 Aspen CO Real Estate Market Monthly Snapshot was released Feb 13… Read More

Aspen SilverGlo 2-Bedroom Condo Sells at $825,000/$1,181 sq ft Versus $595,000/$852 sq ft in Fall 2015

Last Week’s Aspen CO and Snowmass Real Estate Market and Homes for Sale Feb. 4 – 11, 2018, Week 6: Closed (4) + Under Contract / Pending (4) Market Activity Week 6, Feb. 4 – 11, 2018 Estin Report: Aspen CO… Read More

2015 Built McLain Flats Home Sells at $9M/$1,189 sq ft Furnished

Jan. 28 - Feb. 4, 2018 Estin Report: Last Week's Aspen Snowmass Real Estate Sales & Stats: Closed (7) + Under Contract / Pending (14)

The Dec 2017 Market Snapshot was released 01/13/17 in Current Reports. Jan 2018 will be released early this week.

New in Charts in Current Reports

12/23/17: Charts: 2017 Aspen Sales by Neighborhood and Property Type and Downtown Condos Fly High - new charts to be included in my year end 2017 report to be released soon.

11/20/17: Where are we now? Chart Series: 2006 – Q3 2017 Historic Pace of Aspen and Snowmass Village Dollar and Unit Sales (updated every quarter. Q4 2017 update to be updated soon).

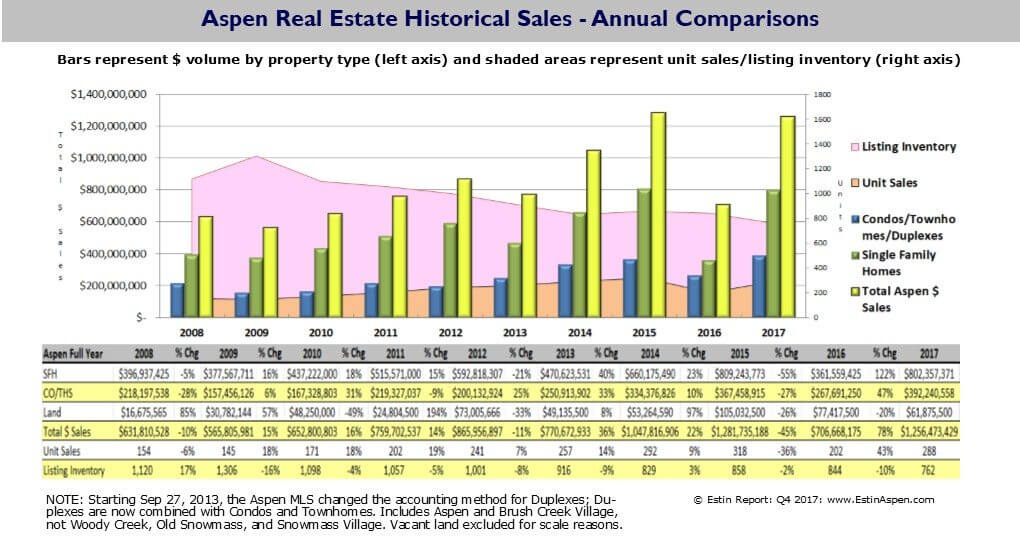

Clients often ask, “Where are we now compared to the Great Recession…?” My interest in creating this series of charts is to answer that question for myself and to offer a visual reference for that conversation – to compare Aspen and Snowmass Village sales activity now to pre-recession mid-2000’s levels...Read more

Bottom Line Dec 2017

"Dec 2017 ended on a weak note compared to what was to an outstanding year. A disappointment in fact. But maybe this was the reprieve we needed after an exceptionally strong three months in August, Sep and Oct ’17.

For the year, dollar sales at $1.512B were almost dead-even with $1.513B in Year 2015; unit sales were also near even with 2015 with (433) in 2017 versus (442) in 2015. Years 2017 and 2015 were remarkably similar to one another and the best performing years of the past ten, 2008-2017, while 2017 had the lowest inventory of properties for sale of that ten year period: (762) listings inventory 2017 vs (858) in 2015, -11%.

Standout categories for the month of December are:

1) Sales of properties over $10M and over at near record of 2015.

For the year 2017, dollar sales of properties $10M and above are up 181% to $442M from $157M in 2016; Unit sales are up 142% to (29) versus (12) last year.

In 2017, $10M and over property sales accounted for $442M, or 29%, of the $1.512B total market dollar sales and (29), or 7%, of the (433) total unit sales.

In 2015, sales of properties $10M and over were $454M, or 30%, of the $1.513B total market dollar sales and (30), or 7%, of the (441) total unit sales.

2) Aspen condos: Sales are up 29% YTD while inventory of available listings is down -18%. High demand and falling inventory is creating price pressure: In the 3-mos sales period from Oct-Dec 17, the avg Aspen Core condo/townhome sold at $1,514 sq ft over $1,252 in the same period Dec 2017, +21%.

3) Where are the Aspen Discounts? Checkout areas a bit farther out of town but more than compensating for the 'relative' distance are the staggering views and high mountain scenery. This is 'Rocky Mountain High' living at its best at sub-prime pricing! Giddy-up folks!! For example, Starwood had (2) sales in the three months of Oct-Dec 17 at an avg $624 sq ft vs $616 sq ft same period a year ago, +1%. The caveat: these sales were for older homes selling essentially at lot value, but for reference, compare this to the avg. (3) downtown SF home sales +31%, $2,227 sq ft in Oct-Dec 2017 vs $1,704 sq ft in the same period last year. Another example is Woody Creek where home prices over $1.5M are still relatively discounted at $1,310 sq ft in Oct-Dec 2017 versus $963 sq ft same time last year. +36%. See Best Deals for Starwood/McLain Flats and Woody Creek properties.

4) Snowmass Village values: SMV is entering its prime winter selling season Dec – April, and unit sales activity has been picking up similar to 2015. The revived Snowmass Base Village under new ownership is completing some major construction projects and the base area if starting to look and feel more finished than the construction site its been for the past 10 years. There is a lot of excitement and positive energy while at the same time, SMV opportunities continue…in general, prices – at 40-60% discount-to-Aspen – are similar, if not down incrementally, from last year... Read More

New Contemporary Aspen CO Homes for Sale or Sold in Past Year

New Aspen contemporary homes are much in demand. Here are: 1) Current Aspen CO listings for sale: Contemporary homes built 2013 or newer for sale in Aspen (24 listings) and Snowmass Village (3 listings) 2) Solds in past year: Contemporary homes built 2013 or newer sold (18 solds)… Read More

2017 Built Half Duplex on Aspen Golf Course Sells for $6.3M/$1,428 sq ft

Jan 21 - 28, 2018 Estin Report: Last Week's Aspen Snowmass Real Estate Sales & Stats: Closed (10) + Under Contract / Pending (12)

The Dec 2017 Market Snapshot was released 01/13/17 in Current Reports.

New in Charts in Current Reports

12/23/17: Charts: 2017 Aspen Sales by Neighborhood and Property Type and Downtown Condos Fly High - new charts to be included in my year end 2017 report to be released soon.

11/20/17: Where are we now? Chart Series: 2006 – Q3 2017 Historic Pace of Aspen and Snowmass Village Dollar and Unit Sales (updated every quarter. Q4 2017 update to be updated soon).

Clients often ask, “Where are we now compared to the Great Recession…?” My interest in creating this series of charts is to answer that question for myself and to offer a visual reference for that conversation – to compare Aspen and Snowmass Village sales activity now to pre-recession mid-2000’s levels...Read more

Bottom Line Dec 2017

"Dec 2017 ended on a weak note compared to what was to an outstanding year. A disappointment in fact. But maybe this was the reprieve we needed after an exceptionally strong three months in August, Sep and Oct ’17.

For the year, dollar sales at $1.512B were almost dead-even with $1.513B in Year 2015; unit sales were also near even with 2015 with (433) in 2017 versus (442) in 2015. Years 2017 and 2015 were remarkably similar to one another and the best performing years of the past ten, 2008-2017, while 2017 had the lowest inventory of properties for sale of that ten year period: (762) listings inventory 2017 vs (858) in 2015, -11%.

Standout categories for the month of December are:

1) Sales of properties over $10M and over at near record of 2015.

For the year 2017, dollar sales of properties $10M and above are up 181% to $442M from $157M in 2016; Unit sales are up 142% to (29) versus (12) last year.

In 2017, $10M and over property sales accounted for $442M, or 29%, of the $1.512B total market dollar sales and (29), or 7%, of the (433) total unit sales.

In 2015, sales of properties $10M and over were $454M, or 30%, of the $1.513B total market dollar sales and (30), or 7%, of the (441) total unit sales.

2) Aspen condos: Sales are up 29% YTD while inventory of available listings is down -18%. High demand and falling inventory is creating price pressure: In the 3-mos sales period from Oct-Dec 17, the avg Aspen Core condo/townhome sold at $1,514 sq ft over $1,252 in the same period Dec 2017, +21%.

3) Where are the Aspen Discounts? Checkout areas a bit farther out of town but more than compensating for the 'relative' distance are the staggering views and high mountain scenery. This is 'Rocky Mountain High' living at its best at sub-prime pricing! Giddy-up folks!! For example, Starwood had (2) sales in the three months of Oct-Dec 17 at an avg $624 sq ft vs $616 sq ft same period a year ago, +1%. The caveat: these sales were for older homes selling essentially at lot value, but for reference, compare this to the avg. (3) downtown SF home sales +31%, $2,227 sq ft in Oct-Dec 2017 vs $1,704 sq ft in the same period last year. Another example is Woody Creek where home prices over $1.5M are still relatively discounted at $1,310 sq ft in Oct-Dec 2017 versus $963 sq ft same time last year. +36%. See Best Deals for Starwood/McLain Flats and Woody Creek properties.

4) Snowmass Village values: SMV is entering its prime winter selling season Dec – April, and unit sales activity has been picking up similar to 2015. The revived Snowmass Base Village under new ownership is completing some major construction projects and the base area if starting to look and feel more finished than the construction site its been for the past 10 years. There is a lot of excitement and positive energy while at the same time, SMV opportunities continue…in general, prices – at 40-60% discount-to-Aspen – are similar, if not down incrementally, from last year... Read More

Five ‘OneAspen’ Townhomes Near Lift 1A Base Close at Avg. $8.55M/$1,732 sq ft

Jan 14 - 21, 2018 Estin Report: Last Week's Aspen Snowmass Real Estate Sales & Stats: Closed (10) + Under Contract / Pending (8)

The Dec 2017 Market Snapshot was released 01/13/17 in Current Reports.

New in Charts in Current Reports

12/23/17: Charts: 2017 Aspen Sales by Neighborhood and Property Type and Downtown Condos Fly High - new charts to be included in my year end 2017 report to be released soon.

11/20/17: Where are we now? Chart Series: 2006 – Q3 2017 Historic Pace of Aspen and Snowmass Village Dollar and Unit Sales (updated every quarter. Q4 2017 update to be updated soon).

Clients often ask, “Where are we now compared to the Great Recession…?” My interest in creating this series of charts is to answer that question for myself and to offer a visual reference for that conversation – to compare Aspen and Snowmass Village sales activity now to pre-recession mid-2000’s levels...Read more

Bottom Line Dec 2017

"Dec 2017 ended on a weak note compared to what was to an outstanding year. A disappointment in fact. But maybe this was the reprieve we needed after an exceptionally strong three months in August, Sep and Oct ’17.

For the year, dollar sales at $1.512B were almost dead-even with $1.513B in Year 2015; unit sales were also near even with 2015 with (433) in 2017 versus (442) in 2015. Years 2017 and 2015 were remarkably similar to one another and the best performing years of the past ten, 2008-2017, while 2017 had the lowest inventory of properties for sale of that ten year period: (762) listings inventory 2017 vs (858) in 2015, -11%.

Standout categories for the month of December are:

1) Sales of properties over $10M and over at near record of 2015.

For the year 2017, dollar sales of properties $10M and above are up 181% to $442M from $157M in 2016; Unit sales are up 142% to (29) versus (12) last year.

In 2017, $10M and over property sales accounted for $442M, or 29%, of the $1.512B total market dollar sales and (29), or 7%, of the (433) total unit sales.

In 2015, sales of properties $10M and over were $454M, or 30%, of the $1.513B total market dollar sales and (30), or 7%, of the (441) total unit sales.

2) Aspen condos: Sales are up 29% YTD while inventory of available listings is down -18%. High demand and falling inventory is creating price pressure: In the 3-mos sales period from Oct-Dec 17, the avg Aspen Core condo/townhome sold at $1,514 sq ft over $1,252 in the same period Dec 2017, +21%.

3) Where are the Aspen Discounts? Checkout areas a bit farther out of town but more than compensating for the 'relative' distance are the staggering views and high mountain scenery. This is 'Rocky Mountain High' living at its best at sub-prime pricing! Giddy-up folks!! For example, Starwood had (2) sales in the three months of Oct-Dec 17 at an avg $624 sq ft vs $616 sq ft same period a year ago, +1%. The caveat: these sales were for older homes selling essentially at lot value, but for reference, compare this to the avg. (3) downtown SF home sales +31%, $2,227 sq ft in Oct-Dec 2017 vs $1,704 sq ft in the same period last year. Another example is Woody Creek where home prices over $1.5M are still relatively discounted at $1,310 sq ft in Oct-Dec 2017 versus $963 sq ft same time last year. +36%. See Best Deals for Starwood/McLain Flats and Woody Creek properties.

4) Snowmass Village values: SMV is entering its prime winter selling season Dec – April, and unit sales activity has been picking up similar to 2015. The revived Snowmass Base Village under new ownership is completing some major construction projects and the base area if starting to look and feel more finished than the construction site its been for the past 10 years. There is a lot of excitement and positive energy while at the same time, SMV opportunities continue…in general, prices – at 40-60% discount-to-Aspen – are similar, if not down incrementally, from last year... Read More

Aspen Pitkin County Real Estate Surpasses $1.9B in 2017, AT

Jan 16, 2018

"(December) 2017 ended on a weak note compared to what was to an outstanding year," wrote broker Tim Estin of Aspen Snowmass Sotheby's International Realty in his most recent Estin Report Aspen Real Estate Monthly Snapshot on Sunday. "A disappointment, in fact. But maybe this was the reprieve we needed after an exceptionally strong three months in August, Sept. and Oct. '17." Read More

Cemetery Ln Area: Aspen Family Home on Snowbunny Lane Closes at $3.79M/$993 sq ft

Jan 7 - 14, 2018 Estin Report: Last Week's Aspen Snowmass Real Estate Sales & Stats: Closed (5) + Under Contract / Pending (9)

The Dec 2017 Market Snapshot was released 01/13/17 in Current Reports. I discovered a Sold Price/Sq Ft bug in the Aspen Glenwood MLS data, and it is in the process of being fixed they say. However, I developed a fix - work around formula - so all figures are accurate.

New in Charts in Current Reports:

12/23/17: Charts: 2017 Aspen Sales by Neighborhood and Property Type and Downtown Condos Fly High - new charts to be included in my year end 2017 report to be released soon.

11/20/17: Where are we now? Chart Series: 2006 – Q3 2017 Historic Pace of Aspen and Snowmass Village Dollar and Unit Sales (updated every quarter. Q4 2017 update to be updated soon).

Clients often ask, “Where are we now compared to the Great Recession…?” My interest in creating this series of charts is to answer that question for myself and to offer a visual reference for that conversation – to compare Aspen and Snowmass Village sales activity now to pre-recession mid-2000’s levels...Read more

Bottom Line Dec 2017

"Dec 2017 ended on a weak note compared to what was to an outstanding year. A disappointment in fact. But maybe this was the reprieve we needed after an exceptionally strong three months in August, Sep and Oct ’17.

For the year, dollar sales at $1.512B were almost dead-even with $1.513B in Year 2015; unit sales were also near even with 2015 with (433) in 2017 versus (442) in 2015. Years 2017 and 2015 were remarkably similar to one another and the best performing years of the past ten, 2008-2017, while 2017 had the lowest inventory of properties for sale of that ten year period: (762) listings inventory 2017 vs (858) in 2015, -11%.

Standout categories for the month of December are:

1) Sales of properties over $10M and over at near record of 2015.

For the year 2017, dollar sales of properties $10M and above are up 181% to $442M from $157M in 2016; Unit sales are up 142% to (29) versus (12) last year.

In 2017, $10M and over property sales accounted for $442M, or 29%, of the $1.512B total market dollar sales and (29), or 7%, of the (433) total unit sales.

In 2015, sales of properties $10M and over were $454M, or 30%, of the $1.513B total market dollar sales and (30), or 7%, of the (441) total unit sales.

2) Aspen condos: Sales are up 29% YTD while inventory of available listings is down -18%. High demand and falling inventory is creating price pressure: In the 3-mos sales period from Oct-Dec 17, the avg Aspen Core condo/townhome sold at $1,514 sq ft over $1,252 in the same period Dec 2017, +21%.

3) Where are the Aspen Discounts? Checkout areas a bit farther out of town but more than compensating for the 'relative' distance are the staggering views and high mountain scenery. This is 'Rocky Mountain High' living at its best at sub-prime pricing! Giddy-up folks!! For example, Starwood had (2) sales in the three months of Oct-Dec 17 at an avg $624 sq ft vs $616 sq ft same period a year ago, +1%. The caveat: these sales were for older homes selling essentially at lot value, but for reference, compare this to the avg. (3) downtown SF home sales +31%, $2,227 sq ft in Oct-Dec 2017 vs $1,704 sq ft in the same period last year. Another example is Woody Creek where home prices over $1.5M are still relatively discounted at $1,310 sq ft in Oct-Dec 2017 versus $963 sq ft same time last year. +36%. See Best Deals for Starwood/McLain Flats and Woody Creek properties.

4) Snowmass Village values: SMV is entering its prime winter selling season Dec – April, and unit sales activity has been picking up similar to 2015. The revived Snowmass Base Village under new ownership is completing some major construction projects and the base area if starting to look and feel more finished than the construction site its been for the past 10 years. There is a lot of excitement and positive energy while at the same time, SMV opportunities continue…in general, prices – at 40-60% discount-to-Aspen – are similar, if not down incrementally, from last year... Read More

1998 Maroon Creek Club Home at 1205 Tiehack Rd Closes in Deal Territory at $5.45M/$813 sq ft

Dec 31, 2017 - Jan 7, 2018 Estin Report: Last Week's Aspen Snowmass Real Estate Sales & Stats: Closed (3) + Under Contract / Pending (5)

The Dec 2017 Market Snapshot will be released early this week. I discovered a Sold Price/Sq Ft bug in the Aspen Glenwood MLS data, and it is in the process of being fixed they say. Stay tuned.

New in Charts in Current Reports:

12/23/17: Charts: 2017 Aspen Sales by Neighborhood and Property Type and Downtown Condos Fly High - new charts to be included in my year end 2017 report to be released soon.

11/20/17: Where are we now? Chart Series: 2006 – Q3 2017 Historic Pace of Aspen and Snowmass Village Dollar and Unit Sales (updated every quarter).

Clients often ask, “Where are we now compared to the Great Recession…?” My interest in creating this series of charts is to answer that question for myself and to offer a visual reference for that conversation – to compare Aspen and Snowmass Village sales activity now to pre-recession mid-2000’s levels...Read more

Estin Report: Nov. 2017 Aspen Snowmass Market Snapshot was posted on Dec 6th in Current Reports.

Nov 2017 Bottom Line

Nov 2017 continues the strong performance we’ve experienced throughout the year. We are close to beating the record year 2015.

Standout categories for the month of November are:

1) Aspen condo sales up 31% YTD while inventory of available listings is off -29%. In the 3-mos sales period from Sep-Nov 17, the avg condo/townhome sold at $1,731 sq ft over $1,346 in the same period Nov 2016, +29%.

2) Value outside Aspen Core: an example of excellent values away from the Aspen Core, Starwood had (3) sales Sep-Nov 2017 at an avg $610 sq ft vs $830 sq ft same period a year ago, -26%. The caveat: these sales were for older homes selling essentially at lot value, but for reference, compare this to the avg. (3) downtown SF home sales at $2,227 sq ft in the same period.

3) Snowmass Village values: SMV has been very active in Nov 17 with (16) sales vs (7) last year, +129%; dollar sales even better – $29.7M vs $6.9M, +331%. Of (4) Ridge Run SFH sales Sep-Nov 17, the avg sale was $635 sq ft vs $1,095 same period last year. SMV opportunities continue…In general, prices are similar, if not down incrementally, from last year. Read More